Automated E-Invoicing Powered by CBS with SAP Business One seamless Integration

We are a generation that has witnessed a list of services and industries getting the prefix ‘E’ before them over decades be it email, E-Commerce, E-Ticketing, E-Banking, and so on. Well, the tax department of the Government is no exception to the trend and digitized the tax system by bringing online tax filing for both individual and business taxpayers. These reforms have revolutionized the Indian tax ecosystem bringing more agility, efficiency, transparency, and security. The latest block in a series of these reforms is E-invoicing.

As we all know Goods and Services Tax (GST) system was introduced. July 2017 is the biggest tax reform of independent India. The system has brought in greater transparency and much-needed riddance from multi-layered tax calculations. However, since the introduction of GST, business organizations have had sleepless nights aligning their workforce, accounting software, ERPs, etc. to conform to the new tax regime. Although Businesses running on advanced GST-ready ERP SAP Business One had a relatively smooth transition compared to others. But seems like the struggle isn’t just over yet. The government committed to making the new tax system even more transparent by bringing in new provisions to GST with the latest being E-invoicing.

E-invoicing is the service that allows electronic verification of B2B invoices by GSTN before further processing on the GSTN portal. Under the novel E-Invoicing system, as soon as a new invoice is made. It will be uploaded to the GSTN portal where it authenticated and post successful authentication. A unique IRN (Invoice Reference Number) is assigned to it by the Invoice Registration Portal (IRP). Through the new system, all the invoice-related information will be shared with both the GSTN portal and the e-way bill portal. Simultaneously thus eliminating the need to manually file the GST return reducing efforts in GST filing drastically.

- Invoices created by the new system would be interoperable i.e. invoices created on software. It can be easily read and interpreted by any other software thus avoiding manual data entry errors.

- Real-time tracking of all invoices

- Automation of various tax processes due to automatic retrieval of details of invoices especially the e-way bills

- Quick calculation of GST credit

- Simultaneous updation Annx 1 of the supplier, Anx 2 of the recipient, and Part A of the e-way bill.

Cogniscient Business Solutions got your back:

Both SAP B1 and its Gold Partners like Cogniscient Business Solutions together have time and again proved their reactiveness towards the fast-changing business landscape and helped their clients to quickly and swiftly adapt to the latest standards and practices.

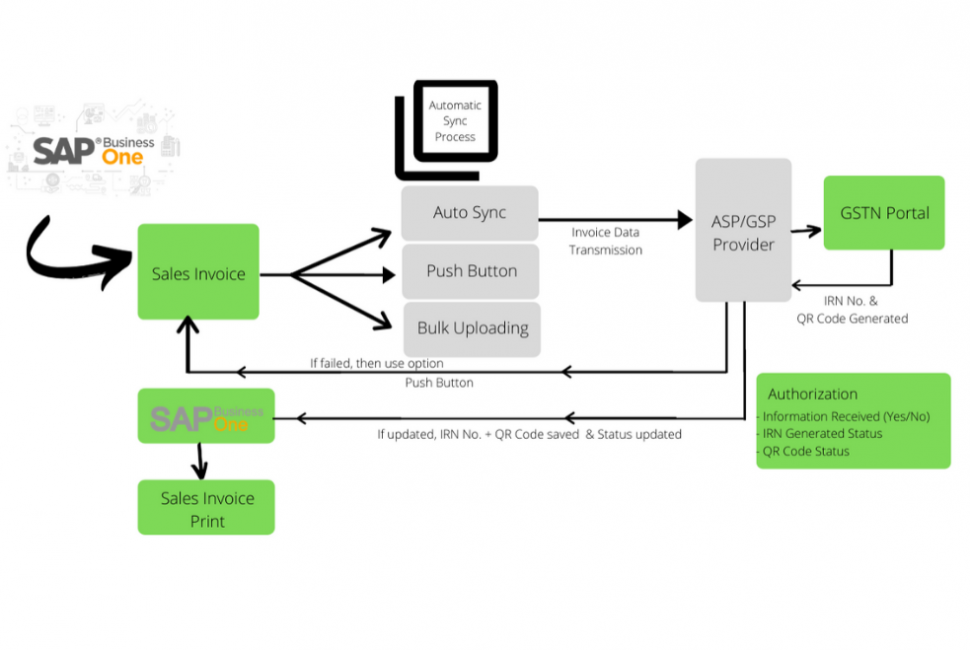

For E-invoicing, CBS has introduced a plugin that can seamlessly integrate with SAP Business One and make the system ready for E-INVOICING as per PEPPOL standards. This plugin interacts with the assigned GSP (GST Suvidha Provider) which further interacts with the GSTN portal. To upload e-invoices in their designated format without any manual intervention. The new system is bound to be a big leap for sincere organizations struggling with inaccuracies and frequent glitches during GST submissions.

Road Forward:

Electronic Invoice System is yet another step of the Government towards its goal of the digital economy. The government committed to making it almost impossible for businesses to evade tax through these novel reforms. These measures are bound to face initial resistance from the taxpayers. But the resultant benefits shall be shared among the entire Indian business ecosystem.